Analysis of Trades and Trading Tips for the Euro

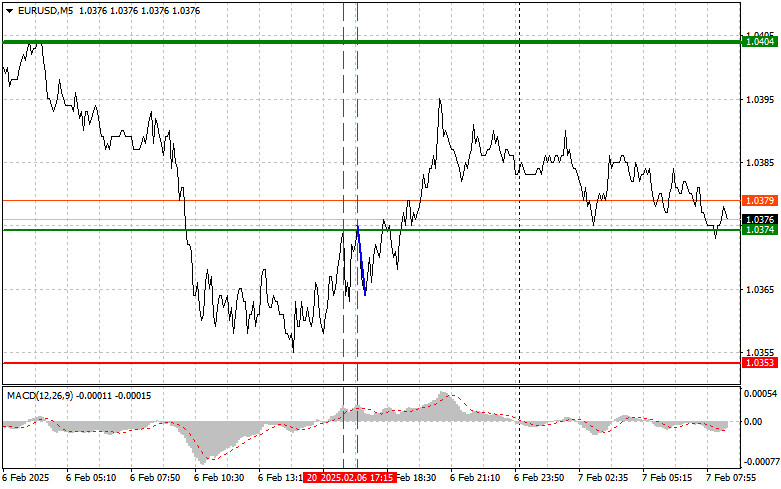

The first test of the 1.0374 price level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upside potential. For this reason, I did not buy the euro. The second test of 1.0374, which came shortly after, took place while the MACD was in the overbought zone. This allowed Scenario #2 to unfold—a short trade aligned with the prevailing bearish trend that had persisted throughout the day. However, after a drop of 11 pips, pressure eased, and the pair resumed its corrective movement.

Recent data from the U.S. labor market confirmed a weakening economic trend. Combined with statements from Federal Reserve members emphasizing the need for further rate cuts, this has put pressure on the U.S. dollar. These factors contributed to the recovery of the EUR/USD pair, which posted a noticeable rally in the latter half of the day. Additionally, expectations of monetary policy easing in the U.S. strengthened the euro's position.

In recent months, Germany's economy has faced multiple challenges, including supply shortages and rising energy costs. These issues could impact today's industrial production results, which serve as an indicator of the current economic situation. Weak figures, especially if they fall below forecasts, could trigger another wave of euro selling in the forex market. Trade balance data also plays a role. If Germany and France report trade deficits, it would exert additional pressure on the euro, as such figures indicate declining competitiveness and weak export demand. Furthermore, Trump's renewed threats of trade tariffs further cloud the euro's outlook.

As for the intraday trading strategy, I will mainly rely on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buying the euro today is possible at the 1.0387 level (green line on the chart), with a target of 1.0413. At 1.0413, I plan to exit the market and initiate a sell trade in the opposite direction, aiming for a 30-35 pip pullback from the entry point. A euro rally in the first half of the day would require strong economic data. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: Another buying opportunity arises if the 1.0371 level is tested twice in a row, with MACD in the oversold zone. This would limit the pair's downside potential, leading to an upward market reversal. The expected targets for this scenario are 1.0387 and 1.0413.

Sell Signal

Scenario #1: I plan to sell the euro at 1.0371 (red line on the chart), targeting 1.0345, where I will exit the short position and enter a buy trade in the opposite direction, aiming for a 20-25 pip rebound. Renewed selling pressure on the pair is likely if economic data disappoints. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I will also consider selling the euro if the 1.0387 level is tested twice in succession, with MACD in the overbought zone. This would limit the pair's upside potential, triggering a reversal downward. Expected downside targets are 1.0371 and 1.0345.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.